In every scaling business, there are visible threats — cash burn, missed targets, operational chaos, macro level events. But some of the most dangerous forces don’t roar. They rule quietly.

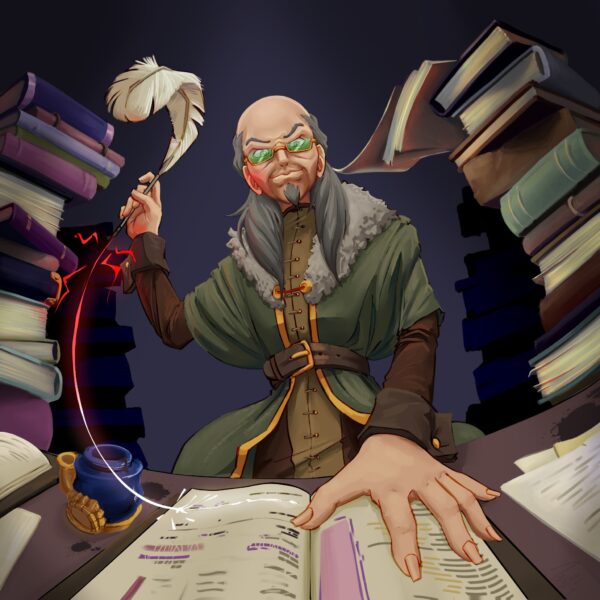

Enter the Lord of the Ledger.

This Myth Monster Character doesn’t crash systems or drain accounts overnight. Instead, it tightens its grip slowly, disguising itself as responsibility, diligence, and “being close to the numbers.” Over time, it can quietly stall growth, distort leadership priorities, and cap a company’s potential — all while appearing productive.

Who Is the Lord of the Ledger?

The Lord of the Ledger is the embodiment of misplaced financial control. He can manifest in two common forms:

- A CEO or Founder who cannot let go of finance and accounting tasks

- A CFO in title only — more comfortable as a controller, but unwilling or unable to evolve into a true strategic leader

In both cases, the problem isn’t effort or intelligence. It’s where energy is being spent — and what isn’t happening as a result.

GET THE DEFENSE PACK!

When the CEO Becomes the Lord

In early-stage companies, founders have to live in the numbers. Cash is tight. Decisions are constant. Resources often don’t exist to properly delegate. Visibility is survival.

But as the business scales, something subtle can happen.

The CEO keeps reconciling. Reviewing transactions. Managing spreadsheets. Approving every journal entry. Asking accounting questions that should already be answered. Not upleveling the staff to free themselves.

It feels responsible. Even noble.

But here’s the truth:

Every hour a CEO spends managing accounting is an hour not spent on the work only they can do. The important work of the CEO can include:

- Setting vision and creating winning culture

- Creating a winning leadership team

- Driving revenue strategy

- Strengthening executive leadership

- Building partnerships and key relationships

- Guiding the company through uncertainty

When a CEO becomes the Lord of the Ledger, the business doesn’t fail — it plateaus. And it does not scale.

GET THE DEFENSE PACK!

When the CFO Is a Controller in Disguise

The second manifestation is more dangerous because it’s harder to spot. On paper, the company has a CFO. In practice, the role is dominated by:

- Historical reporting

- Accounting oversight

- Process management

- Close cycles and compliance

These are important functions — but they are table stakes, not the job.

A true CFO doesn’t lord over the ledger. They translate it.

They use financial data to:

- Pressure-test strategy

- Forecast risk and opportunity

- Shape capital decisions

- Align metrics with growth goals

- Challenge leadership assumptions

- Drive crucial conversations

When the CFO seat is occupied by someone who is most comfortable guarding the books, the company lacks financial leadership — even if the numbers are pristine. And leadership is not an inherited skill, it is learned and honed over time. The role of the controller is critical, but be careful to not mistake the accounting department as the leaders of finance.

Why the Lord of the Ledger Is So Persuasive

This Myth Monster thrives because it hides behind good intentions.

- “I just want to stay close to the numbers.”

- “No one understands this like I do.”

- “We can’t afford mistakes right now.”

But control is not the same as clarity. And proximity is not the same as insight.

Scaling businesses don’t fail because leaders care too much — they stall because leaders are pulled into the wrong altitude of work.

The Real Cost of This Myth

The damage caused by the Lord of the Ledger rarely shows up as a single line item. Instead, it appears as:

-

Executive Drain: Trading market-shifting vision for transactional minutiae.

-

Decisional Paralysis: Waiting for “perfect” historical data while market windows close.

-

Strategic Drift: Navigating by the rearview mirror instead of the horizon.

-

Founder Burnout: The mental tax of playing Accountant instead of Visionary.

-

Operational Bottlenecks: Teams paralyzed by a “permission-only” financial culture.

The company keeps moving, but never quite breaks through. It can be different if you vanquish the myth within!

GET THE DEFENSE PACK!

Vanquishing the Lord of the Ledger

Defeating this Myth Monster isn’t about stepping away from financial visibility. It’s about elevating it.

- CEOs must let go of managing finance and step fully into leading the business

- CFOs must move beyond accounting stewardship into strategic partnership

- The ledger must become a tool for insight, not a throne for control

When finance is positioned correctly, it doesn’t dominate leadership time — it amplifies it.

The Question Every Scaling Leader Must Ask

Are you using your financial data to drive the future of your business —

or are you ruling the past, one ledger entry at a time?

Because the Lord of the Ledger doesn’t announce himself. He simply takes the seat — and quietly limits what’s possible.

Ready for the next step?

The Lord of the Ledger thrives in businesses that have outgrown their financial structure — but not their financial leadership.

In a 30-minute Reality Check, we’ll review:

- Where your CEO time is really going

- Whether your CFO function is strategic or transactional

- How well your financial data is supporting forward-looking decisions

No pitch. Just clarity.

Book Your 30-Minute Reality Check

Not quite ready to talk?

GET THE DEFENSE PACK!